12 May 2023

12 May 2023

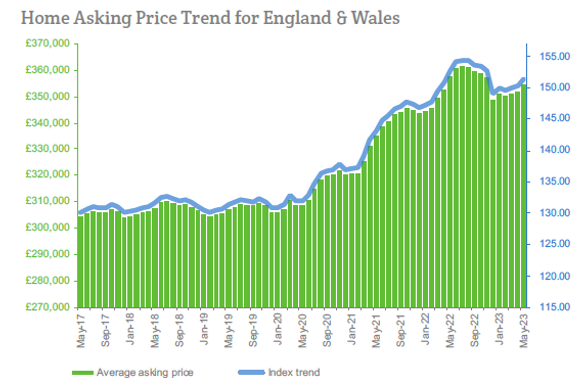

Rising asking prices across all English regions, Scotland and Wales indicate a renewed level of confidence among vendors and a further bold step along the road to recovery, according to Home.co.uk's Asking Price Index for May.

At the same time, rising stock levels and longer marketing times, while normal for the time of year, will both serve to restrain further price hikes going forward. Of course, overly optimistic pricing risks a stand-off between buyers and sellers that could spark a further price correction and stall the market.

To date, the recovery of the UK property market in the wake of the interest rate shocks is well underway. Prices underwent a significant correction and subsequently the market regained much lost momentum. This month's data is consistent with the typical operation of the marketplace for the time of year. In fact, the current key indicators are completely in line with market observations for the seven years prior to the pandemic.

More cautious pricing might have been expected given the considerable uncertainty about interest rates. However, vendors appear to have brushed aside the Bank of England's hand-wringing and negative messaging that was seemingly designed to undermine buyer confidence and create a fearful climate of wait-and-see hesitancy.

The most startling example of seller confidence during April was in the South East, culminating in a jump of 1.6% and making up for some of the ground lost during the correction. Buyers will be reminded that the market moves on quickly and the time for bargain-hunting is short.

Meanwhile, markets in the northern regions of England, Wales and Scotland are in great shape and continue to operate with marketing times much lower than in pre-COVID years. The North East sales market in particular has been transformed beyond recognition. It is in these areas that home price growth remains positive year-on-year and where we expect the most growth going forward.

Although mortgage rates have crept up slightly, they remain extraordinarily low compared to the rate of inflation and this will continue to support demand and aid the recovery.

Fixed-rate deals are still available below 4% while inflation remains stubbornly north of 10% (either CPI or RPI). Moreover, the same goes for remortgage rates and this serves to prevent the flood of repossessions that would be inevitable if interest rates were over and above the rate of inflation as they were in the 1970s.

Headlines

- Asking prices across England and Wales surged during April by 0.8% on a wave of optimism, although year-on-year growth slipped further into the negative (-0.8%).

- The Typical Time on Market for unsold property in England and Wales increased by four days during April to make the current median 81 days, in line with seasonal expectations.

- Asking prices in April rose in Scotland, Wales and all English regions. The steepest rise was in the South East (+1.6%).

- The total sales stock count for England and Wales increased again during April by 21,077 to reach 409,559. This further significant rise takes the total to just under the 10-year average of 418,885.

- The supply rate of new instructions entering the market remains relatively restrained: up 5% on April 2022 but down 6% on April 2021.

- Typical Time on Market rose in all English regions during April but fell in Scotland and Wales.

- The Scottish property market remains the new leader in terms of annualised regional price growth (5.5%), while London is the laggard at -3.0%.

- Rents across the UK continue to rise (12.4% annualised) led by Greater London (up 18.7%). Supply remains very tight in the lettings sector.

- The current new growth leaders in asking rents are the London boroughs of Bexley and Hillingdon (+32% and +30% annualised respectively).

For media enquiries please contact: press@home.co.uk 0845 373 3580

More information is available here.

Follow us on Twitter.